This guide goes through annual vacations the settings of annual vacation calculations in Tuntinetti.

Deployment of Annual vacation calculation in Tuntinetti

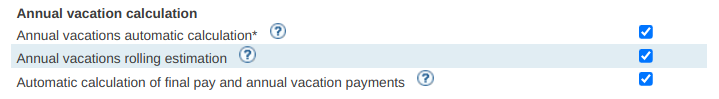

1. The additional features

There are three additional features related to vacation calculation: Annual vacations automatic calculation, Annual vacations rolling estimation and Automatic calculation of final pay and annual vacation payments.

To activate calculation of annual vacation earnings, at least the first one must be activated.

The rolling estimation calculates a rolling estimate of earned paid vacations into each hourly report, in addition to annual vacation calculation.

Automatic calculation of final pay and annual vacation payments, enables automatic generation of payment orders for spent annual vacation and final salary events.

1.1 General

It is recommended that annual vacation earning calculation in Tuntinetti is started earliest from the year for which work time has been tracked completely in Tuntinetti since previous April (the date on which vacations start to accumulate 1. April). Regardless whether annual vacation earnings are calculated using Tuntinetti, vacation payments are made either from report summaries or in Users → Earned vacations, flex time and payments section, even if the annual vacations automatic calculation setting is activated.

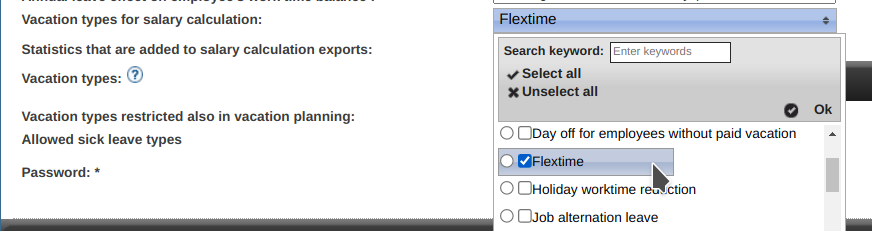

Then also make sure that annual vacation is selected in the Company's basic information - Vacation types, so that they are included to the salary calculation exports.

1.2 Percentage based vacation compensation

So called percent based vacations require that the annual vacations automatic calculation feature is activated (but it doesn't require the Annual vacations rolling estimation). Usually in this case you can define that all employees who work irregularly get the percent based salary in every payslip. This can be done in the Vacation calculation preferences menu of the Company's basic information tab. (Individual contracts may be exempted from this rule with a Employment contract additional information -option: Calculate paid vacation normally even though there is no regular work time.) This payment will then also be included to the export of the salary calculation (requires that annual vacation is selected in the Company's basic information - Vacation types). If the percent based vacation salary payment in every account doesn't affect every employee who work irregularly (or if you want to pay percent based in every salary for some of the employees with standard working hours), the accumulation rule can be individually set for every employee in the employment contract's additional information.

2. Annual vacation setting management

Annual vacation calculation can be company, unit or employee specific. Employee specific calculation overrides unit specific and unit specific calculation overrides company specific settings. This way you can set annual vacation calculation for individual employees, units or employees of the whole company. The menus and settings concerning annual vacation calculation will only be visible after the Annual vacations automatic calculation feature is activated.

Activating Annual vacations automatic calculation in the middle of a vacation earning year (for example 1.4.2017 - 31.3.2018) requires that Tuntinetti has employees' work time tracking information at least from the start of the vacation earning year (for example 1.4.2017). Annual vacation earning (and sometimes also vacation salary) is determined by work time during vacation earning year. If work time tracking of the earning year isn't complete, vacation days (and possibly vacation salary) are not earned correctly.

2.1 Company specific settings

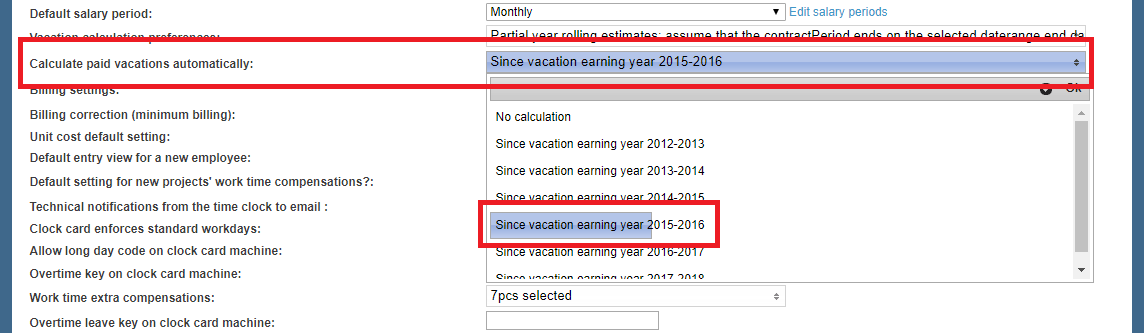

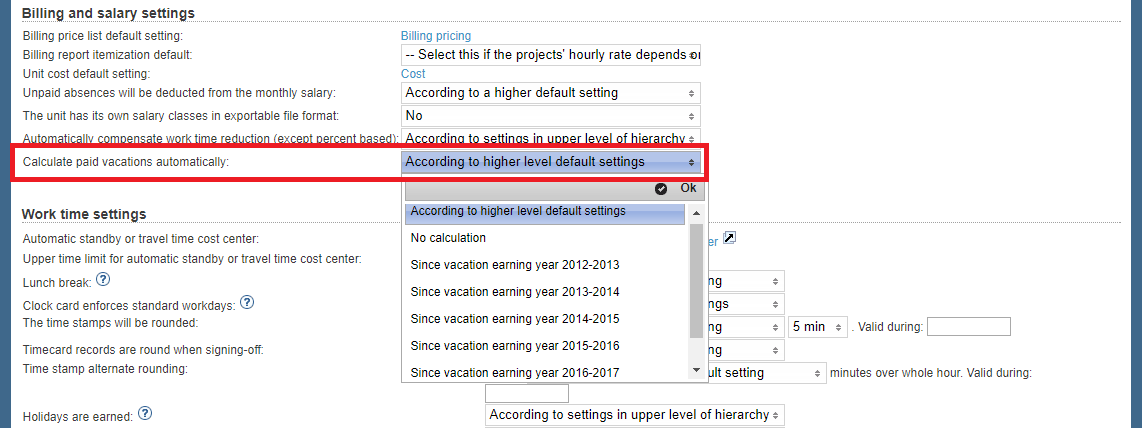

In the Company's basic information tab there is "Calculate paid vacations automatically" menu where you can select:

"No calculation" - This means that vacation calculation must be individually set for desired units or employees.

"Since vacation earning year XXXX-(XXXX+1)" - This means that the default setting for the company's employees is that the vacations are calculated from the selected earning year. For example if the earning year is set to be 2012-2013, the calculations are started from the earning year 1.4.2012-31.3.2013. This setting can be overridden with unit or employee specific settings if there are units or employees which need to have a different first vacation earning year.

There are two ways to track annual vacation balances in Tuntinetti:

Employees track their annual vacation balances and supervisors can add vacation payments in Tuntinetti. Vacation and payment tracking is done separately. (This can be activated with the Separate tracking for paying and using of paid vacation setting, which is described below.) According to the law (Vuosilomalaki), annual vacation days accumulate new annual vacation, and therefore vacation calculation needs to know when annual vacation was used. That is why annual vacation automatic calculation feature needs this setting.

There is only one balance for annual vacations. It is suitable for companies that don't use Tuntinetti to make vacation payments (balance acts as a balance for vacations), or for companies that don't track used vacation days to work time tracking but only reportable vacation balance changes (balance acts as a balance for vacation days that need to be paid). This method is not recommended to be used with Annual vacation automatic calculation feature, because vacation calculation needs to know when annual vacation days were used.

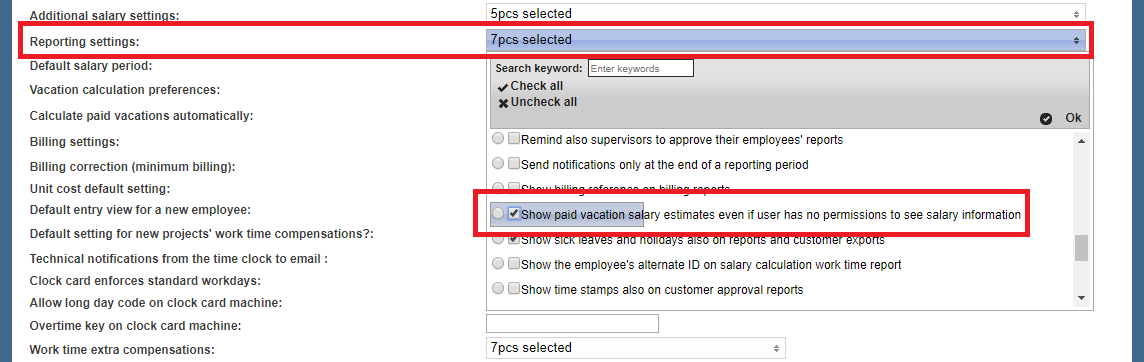

Vacation salary and vacation payment information are only visible by default for employees who have the rights to see salary information. This limitation can be removed: Basic settings → Company's basic information → Reporting settings "Show paid vacation salary estimates even if user has no permission to see salary information".

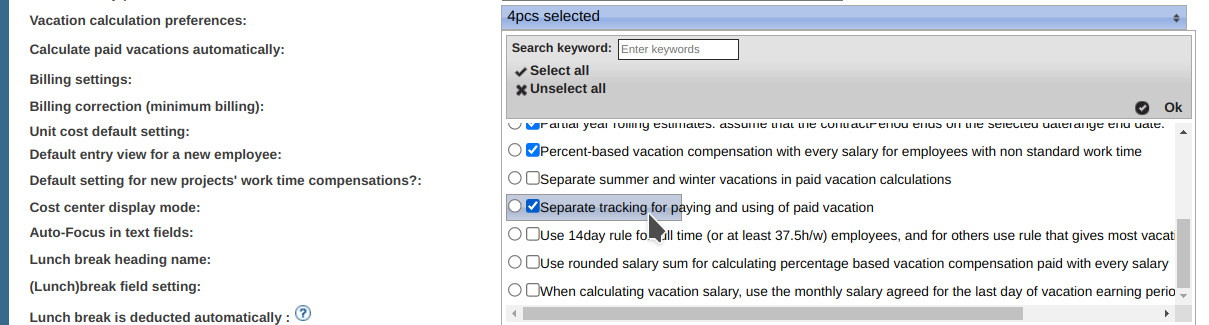

Settings that are in the Vacation calculation preferences menu:

Separate tracking for paying and using of paid vacation - For companies which track vacation salaries' and vacation compensations' payment orders in Tuntinetti. This way payment of vacation salaries doesn't affect on the available vacation days and vice versa.

Separate summer and winter vacations in paid vacation calculations - Summer vacation is automatically separated on the paid vacation calculation (max 24 days).

Percent-based vacation compensation with every salary for employees with non standard work time - This setting overrides the annual vacation calculation of every non standard work time contracts to be a percent based vacation compensation. The compensation is paid in every salary. More detailed definitions can be done employment contract specific (more information about employment contract specific definitions in the chapter Annual vacations#2.4 Employment contract specific settings).

Monthly salary paid during paid vacation (when using separate tracking for paying and using of paid vacation) - Employees who are monthly paid get also a normal salary from vacation days. This works if you want to pay vacation salary only the vacation salary that has accumulated from time compensations and other compensations. For this setting to work the "Separate tracking for paying and using of paid vacation" setting must also be activated.

Use rounded salary sum for calculating percentage based vacation compensation paid with every salary - When a vacation compensation is calculated for each salary payment a percent amount of the compensation is calculated using the salary amount (in cent accuracy).

Calculate paid vacation combining work time from all contract series - Usually different contract series are calculated with different vacation salary calculations. This setting works if earned vacation days and vacation salaries are calculated based on the whole working effort over different contract series (vacation salaries are calculated separately for each collective labour agreement and month based contract series).

Use 14day rule for full time (or at least 37.5h/w) employees, and for others use rule that gives most vacation days. - This setting can be used to always use 14day vacation earning rule for full time (at least 37.5h/w) employees, and for others to choose 35h rule only if it earns more vacation days than the 14day rule.

When calculating vacation salary, use the monthly salary agreed for the last day of vacation earning period - With this setting you are able to define that vacation calculation that is based on monthly salary doesn't take into account raises which are given after the vacation earning period.

Partial year rolling estimates: assume that the contract period ends on the selected date range end date. - When vacation salary estimate is calculated for a part of the rest of the year, it is calculated on that premise that the employment contract will end on the end date of the selected date range.

Contract periods with non standard work time are ignored when calculating vacations for contracts with standard work time. - When vacation salary calculation is calculated for a standard work time contract, previous non standard employment contracts are not counted when defining the length of the employment contract (has an effect for example to the vacation percent of the first / next vacation years).

In the due paid vacation salaries report, show only vacations earned during the vacation year of the end date of the selected date range - This setting hides due vacation payments from due vacation salaries report that have not been paid.

Hide employment end final pay calculations for dates prior to the selected end date from due vacation salaries report - This setting hides final pay calculations from due salaries report that have accumulated before a selected time range.

Include only weeks that have activity towards annual vacation averaged hourly salary calculation - Weeks that haven't got any work time markings are not taken into account for employees with non standard work hours, whose vacation salary is calculated based on the averaged hourly salary.

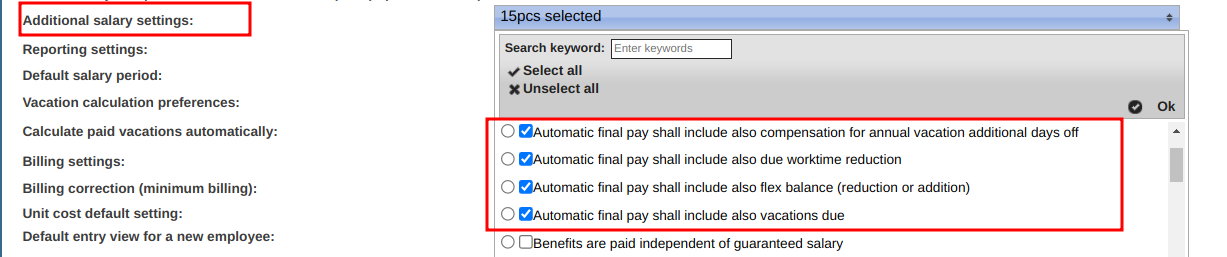

2.1.1 Additional settings for feature Automatic calculation of final pay and annual vacation payments

If the feature Automatic calculation of final pay and annual vacation payments is enabled, you can choose the vacation types that the final pay payments are calculated for:

Notice! in order for the above mentioned final pay payments to be automatically paid, the vacation types must also be selected in the list Vacation types for salary calculation:

The automatic annual leave payment calculation also needs the setting: Vacation calculation preferences: Separate tracking for paying and using of paid vacation.

2.2 Unit specific settings

If the feature Automatic calculation of final pay and annual vacation payments is enabled, the "Calculate paid vacations automatically" menu in the Units tab has the following options:

"According to higher level default settings" - This setting makes the unit use the default setting that is set as in the section Annual vacations#2.1 Company specific settings.

"No calculation" - With this setting annual vacations are not calculated by default for the unit's employees (individual employees can still have annual vacation calculation, but it must be activated like in the Annual vacations#2.3 User specific settings section).

"Since vacation earning year XXXX - (XXXX+1)" - With this setting the default setting is that all of the unit's employees' annual vacations are calculated from the selected vacation earning year.

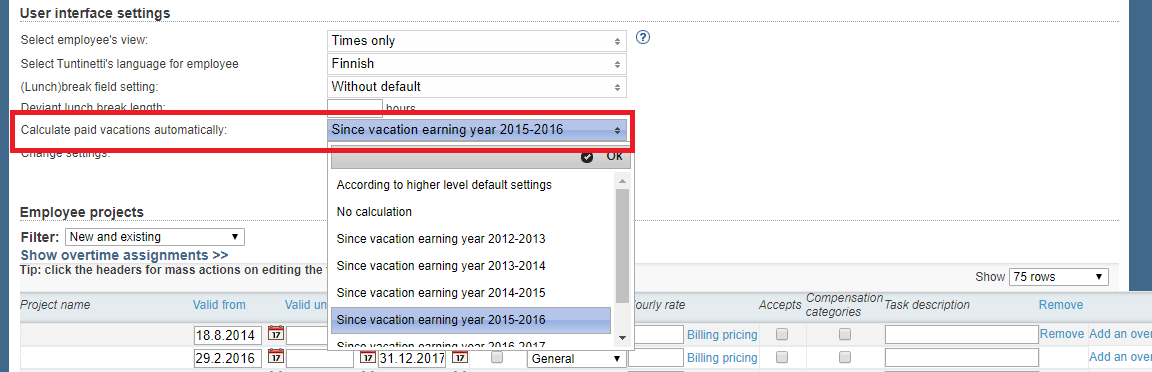

2.3 User specific settings

Respectively, the "Calculate paid vacations automatically" menu in the Employees tab has the following options:

"According to higher level default settings" - This setting makes the employee use the default setting that is set as in the section Annual vacations#2.2 Unit specific settings.

"No calculation" - With this setting annual vacations are not calculated for the employee regardless of what settings are selected in the sections 2.1 or 2.2.

"Since vacation earning year XXXX - (XXXX+1)" - With this setting the employee's annual vacations are calculated from the selected vacation earning year regardless of what settings are selected in the sections 2.1 or 2.2..

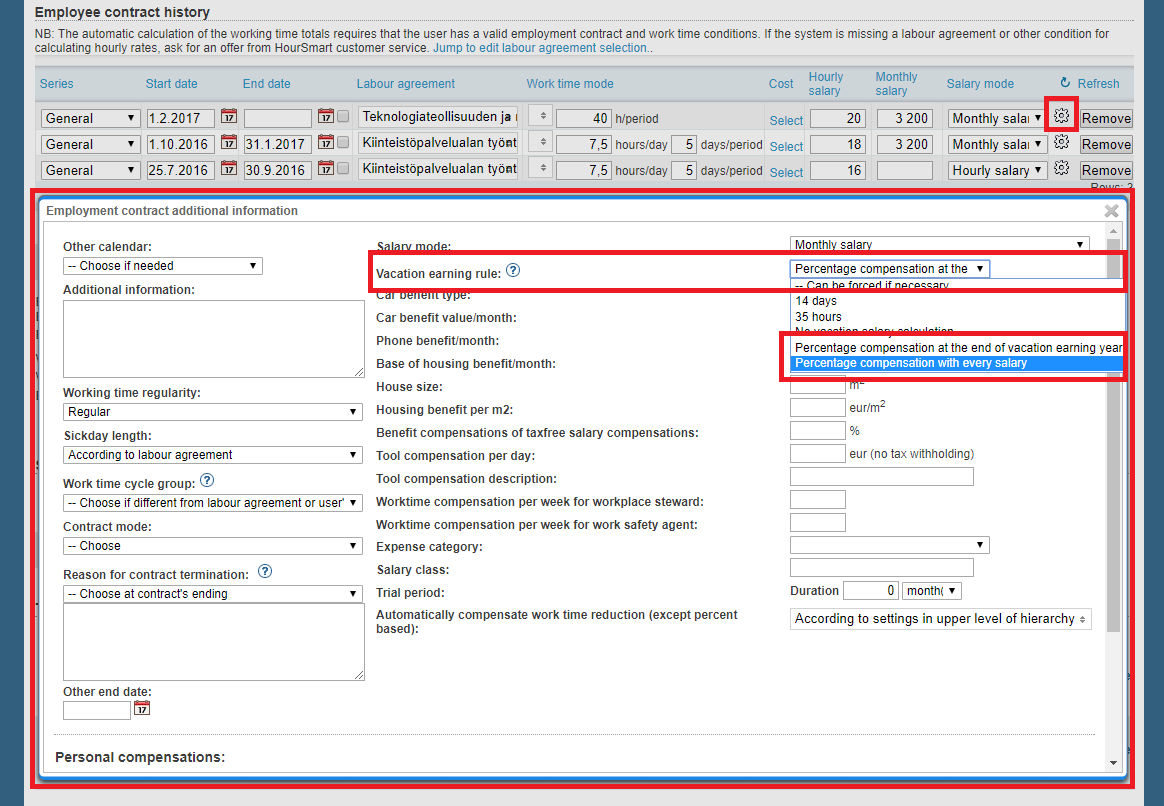

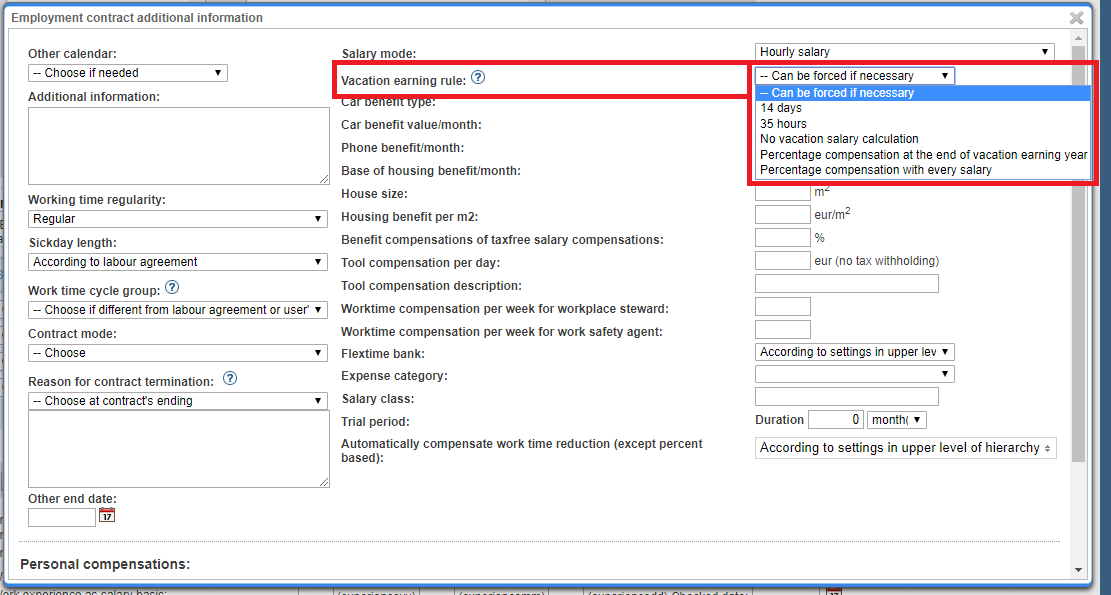

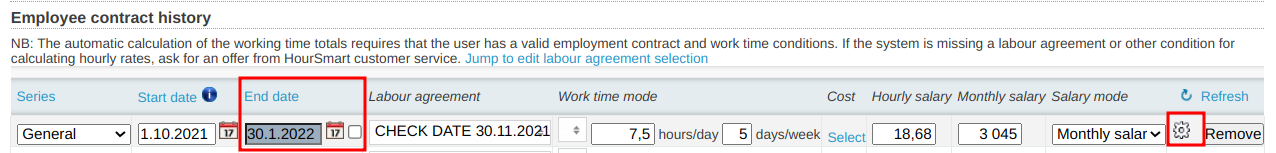

2.4 Employment contract specific settings

There is a cog wheel button () in the Users → Employees tab's Employee contract history list after each contract. With this button you can open the employment contract's additional information window which contains a setting to override the earning rule for that particular contract. You can for example select the contract's vacations to be replaced with a percent based compensation at the end of the vacation earning year (if the employment contract ends or essentially changes before the vacation earning year ends, the compensation will be paid at the end of the employment contract). Another percent based choice is that vacations are compensated as a percentage on each salary.

3 Vacation balance

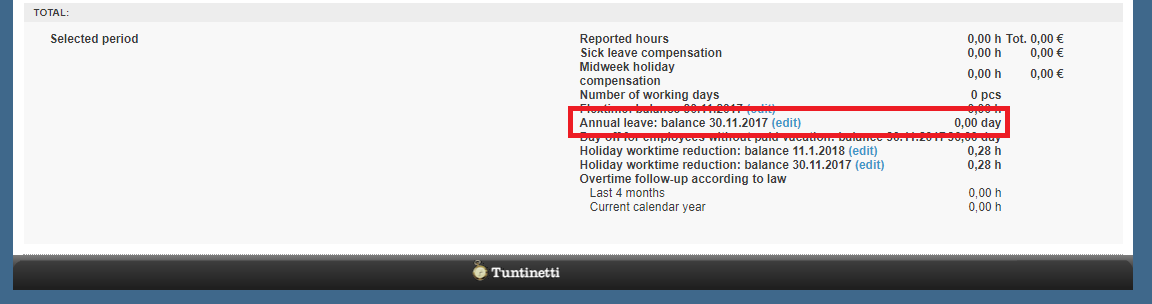

3.1 Vacation balance

Vacation balances can be viewed in an employee's time report summary. If the first sections setting “Separate tracking for paying and using of paid vacation“ is not activated, the summary will have only one number "Annual leave: balance".

3.2 Available vacation balance

If the 2.1 section's "Separate tracking for paying and using of paid vacation" setting has been activated, annual vacation balances are separated to "available balance" and "due balance". The available balance means the amount of annual vacation that an employee can enter in the work time tracking. Vacation days are available only after the vacation period has been started. For example the earned vacation days from the vacation earning period 1.4.2013 - 31.3.2014 are on the available balance when the time report is taken from the date 2.5.2014 or after. If there are vacation days that haven't been used from the previous years, they are included in that balance.

3.3 Due vacation salary balance

Due vacation salary balance is the amount of annual vacation that an employee has already earned, but has not been marked as paid. (see also 5. Marking vacation balance as paid) Vacation days are visible on the due vacation balance as soon as the vacation earning period has ended. For example the earned vacation days from the vacation earning period 1.4.2013 - 31.3.2014 are on the available balance when the time report is taken from the date 31.3.2014 or after. If there are vacation days that haven't been used from the previous years, they are included in that balance. This balance can be paid off by:

adding a payment for the vacations during the selected time report (see 4.5 Automatic payment orders for annual vacation)

at the end of employment, by adding a final salary payment (see 4.6 Final pay)

by adding a custom payment in the Earned vacations, flex time and payments section

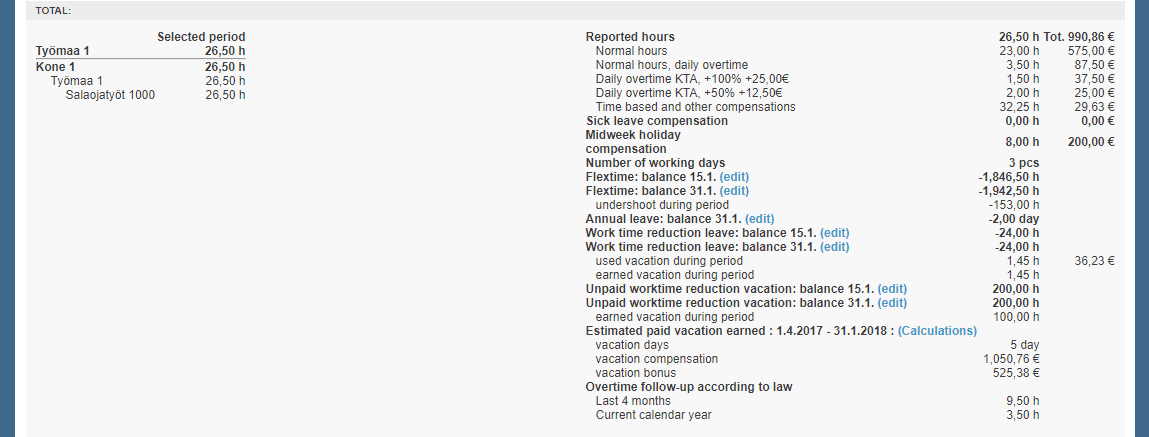

3.4 Earned annual vacation

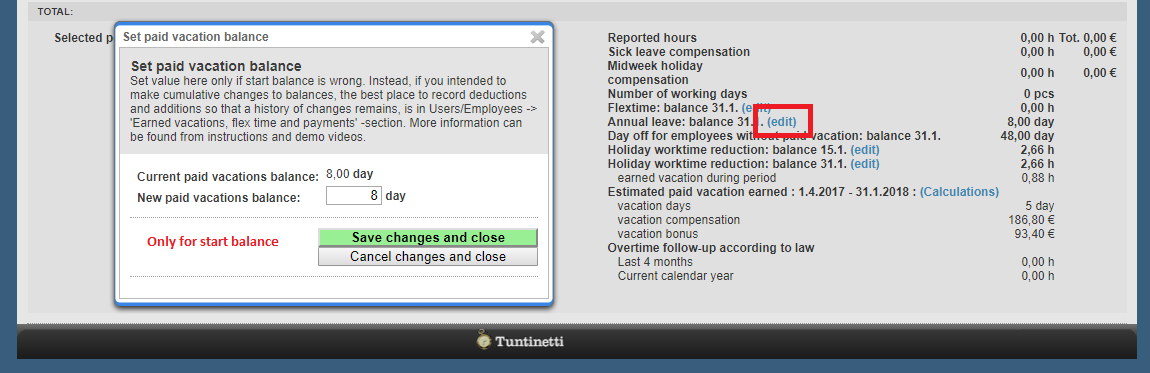

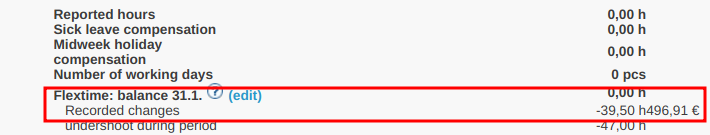

When a time report for payroll has a period that includes employees at the end date of the vacation earning period (for example 31.3.2014), the summary details vacation earning of the vacation earning period that has ended. The summary contains the number of earned vacation days, earned vacation salary and vacation bonus if applicable. A superuser can change the automatically calculated values with the "edit" button.

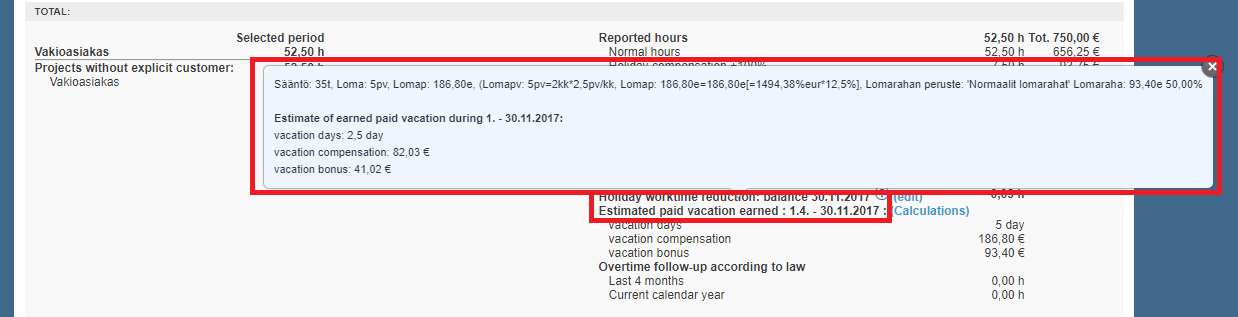

3.5 Vacation earning estimations

If the feature Annual vacations rolling estimation is activated and the selected date range ends before employee's vacation earning periods end date, the summary and includes an estimate of the earned vacation days, vacation salary and vacation bonus earned during the partial vacation earning period. The estimate is calculated to the accuracy of half a vacation day, for example 7.5 days. The final rounding to full days as defined by law, is done only when calculated time period contains the whole vacation earning period. Partial earning period vacation calculation estimations can't be manually changed.

4. Annual vacation calculations

When the Annual vacations automatic calculation feature is activated (Section 1) and annual vacations are defined to be calculated to everyone or a part of employees or units, the vacation calculations are visible in the following ways.

4.1 Work time tracking summary

Annual vacation calculation is visible on the time report for payroll when the selected date range includes the vacation earning period's ending date.

By hovering your mouse cursor over the heading "Earned paid vacation XXXX-YYYY" a tool tip describes of the annual vacation calculation.

If you want to add a starting balance to the annual vacation calculation manually, there is an "edit" button next to the calculation. This opens up a window where you are able to change the amount of paid vacation balance.

If the feature "Annual vacations rolling estimation" is activated (Section 1), the annual vacation estimation is visible even if the selected time period doesn't include the ending date of the vacation earning period. In this case the annual vacation calculation will be an estimation. This estimation can't be manually changed.

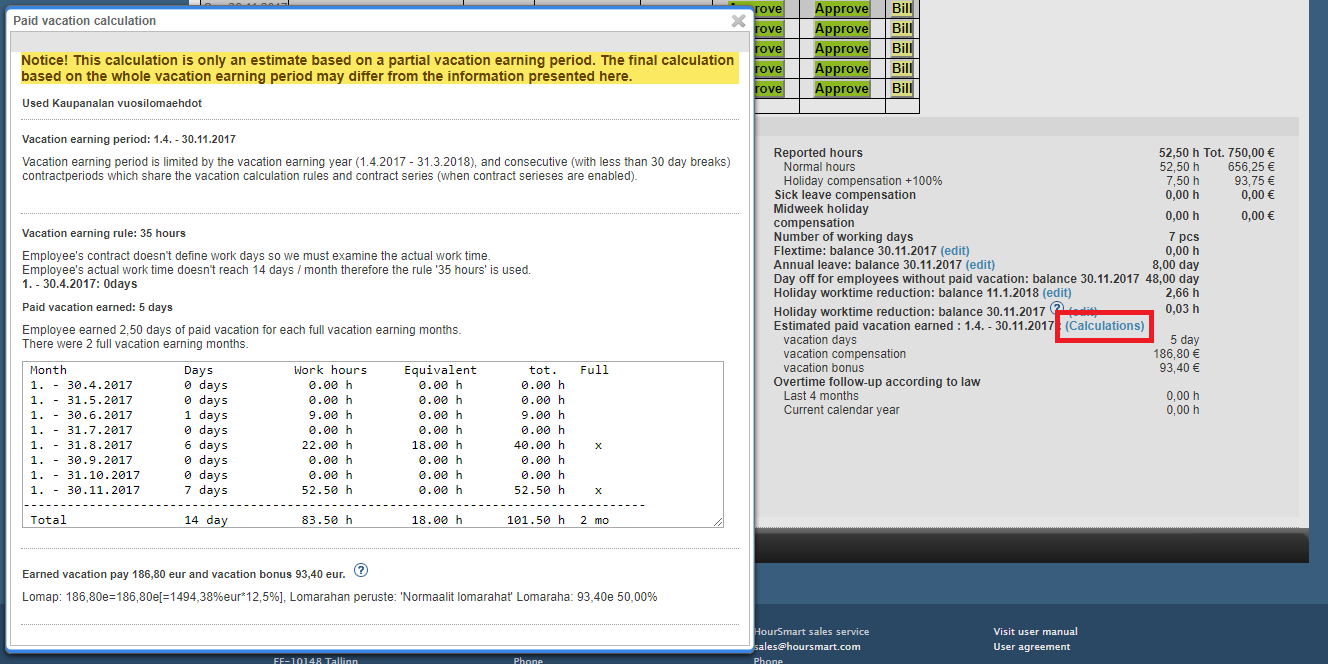

4.1.1 Annual vacations automatic calculation

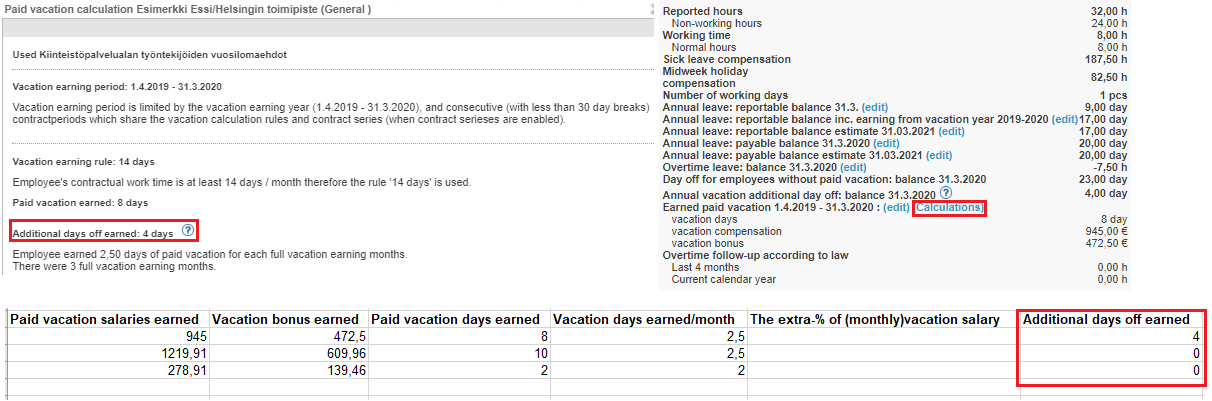

You can view how the software calculates vacations by clicking the "Calculations" button. This opens up a new window, which has employee's planned work days, employee's actual work days and the collective labour agreement, which defines how vacation days are earned.

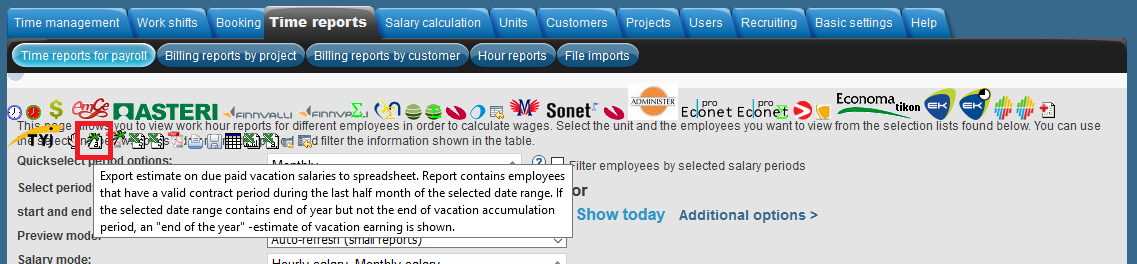

4.2 Due vacation salaries report

The due vacation salaries report can be downloaded with the icon on top of the page. The report includes the vacation debt of the selected employees at the end of the selected time range. If the selected date range contains the last day of a calendar year (31.December), the report will also contain the estimated vacation earning at the end of the calendar year, calculated to the accuracy of half a vacation day (rounding to full days is only done at the end of a vacation earning period). The report also includes information like the vacation balances and details of the vacation calculations. If the above mentioned setting "Separate tracking for paying and using of paid vacation" is activated, the due vacation salaries report includes two separate balance columns: Annual vacation balance (available) and Annual vacation balance (due). An individual employee may have multiple rows per vacation debt report. Each row signifies a vacation earning event subtracted by corresponding used/paid vacation. Each row therefore lists how much vacation is still unused/unpaid for each vacation earning.

4.3 Viewing developments in due paid vacation history

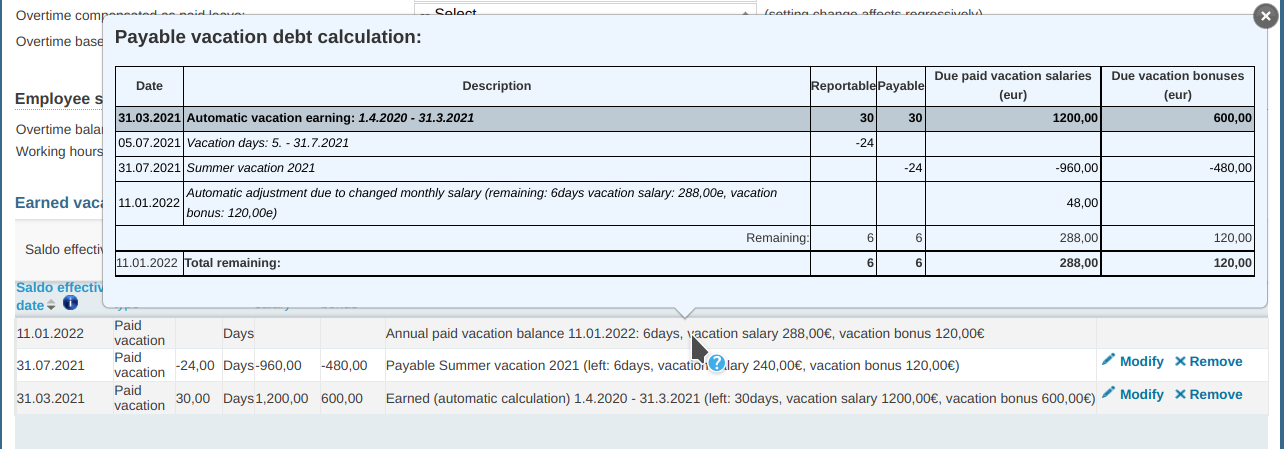

Developments in due reportable / payable paid vacation saldoes and salaries can be inspected in the view Earned vacations, flex time and payments. Each paid vacation row in that view has a tool tip containing developments in due paid vacation history until that row.

Red color on a summary row indicates that at the end of that vacation year, payable and reportable vacations saldoes differ. Beginning from vacation period XX.-XX.XX.XXXX, vacations have been reported faster than they've been paid. The situation on XX.XX.XXXX is that XX days of earned and reported vacations has not yet been paid. This can be corrected by checking that all vacation days marked on the work time report have been paid, and all paid vacation days are marked on the work time report.

4.4 Due paid vacations are updated automatically at certain situations:

When monthly salary is increased (unless setting "When calculating vacation salary, use the monthly salary agreed for the last day of vacation earning period" is turned on)

When due annual vacation converts to postponed annual vacation (vacation salary will be calculated based on the last ended annual vacation earning year)

In some collective labour agreements, for example in the field of first aid (Ensihoitopalveluala) vacation days and vacation salaries are updated as winter vacation extension rule activates

These updates are shown in the tooltips of the view Earned vacations, flex time and payments, on rows labelled "Automatic adjustment due to..." as seen in the screenshot above.

4.5 Automatic payment orders for annual vacation

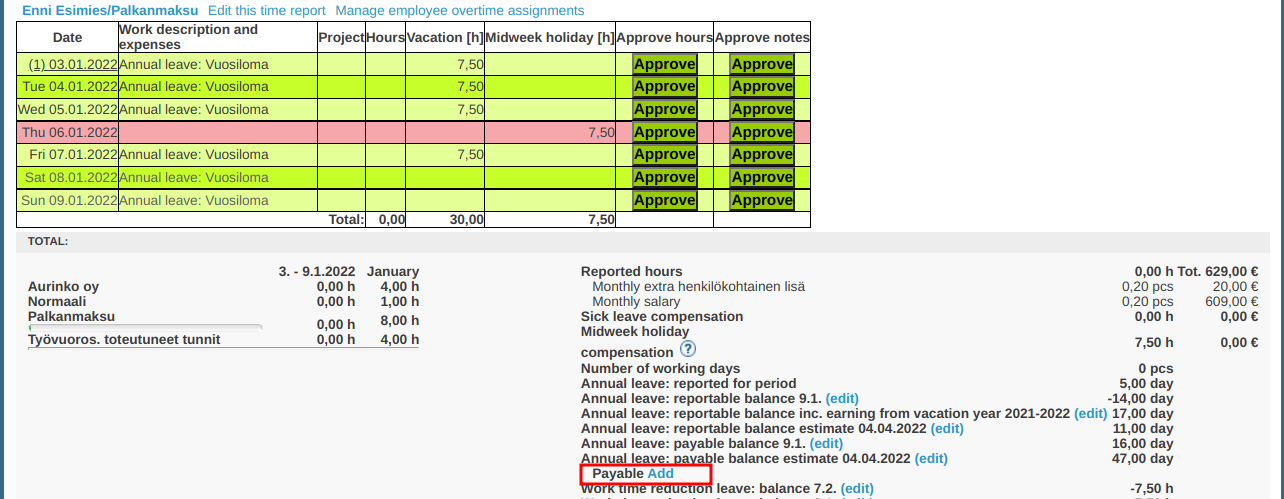

When annual vacations have been entered to the time reports, supervisor can create a payment for the used vacation days, by clicking the button: Payable: Add.

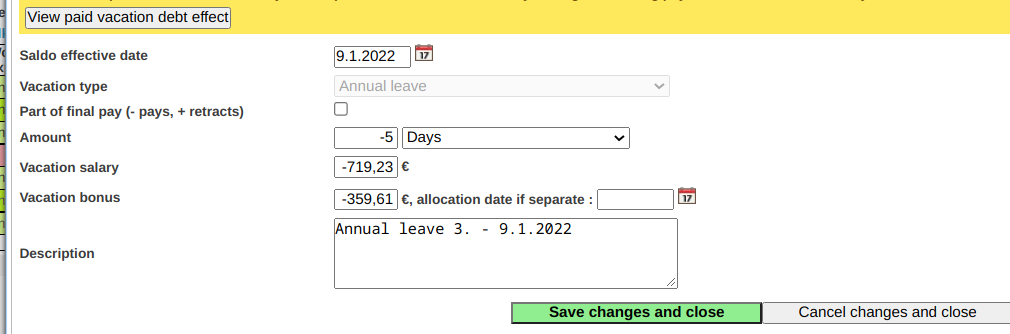

Tuntinetti will then generate a payment suggestion for the last vacation day. If the feature: Automatic calculation of final pay and annual vacation payments is enabled, also the vacation salary and bonus are automatically calculated:

By clicking the button "View paid vacation debt effect", supervisor may check how the edited payment will effect the vacation paid vacation debt.

4.6 Final pay

To calculate final pay, first the contract period is ended in Tuntinetti, and the ending reason is given in the additional information popup of the last contract period.

Final pay earning is calculated before employment end date even without Annual vacations rolling estimation -feature, if time reports have been filled until the end of employment, or if employment ends within two calendar months of the current date.

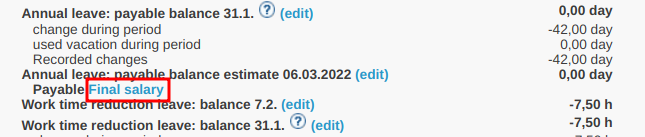

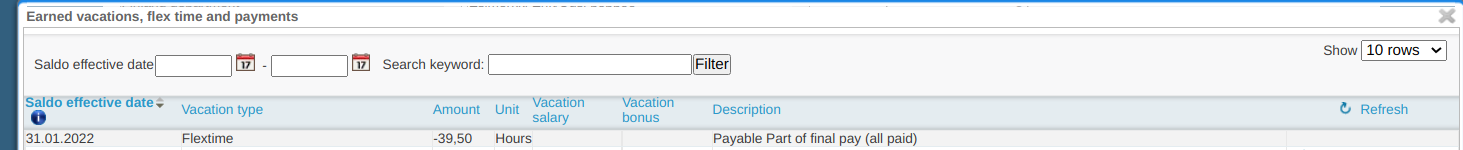

When time reports are completed for the duration of employment, the compensation payment for unused paid vacation can be created manually by opening the time report with the date range containing the end date, and clicking the button Payable: Final salary.

If the feature Automatic calculation of final pay and annual vacation payments is enabled, the paid vacation compensation and vacation bonus are calculated automatically to the Final salary payment popup.

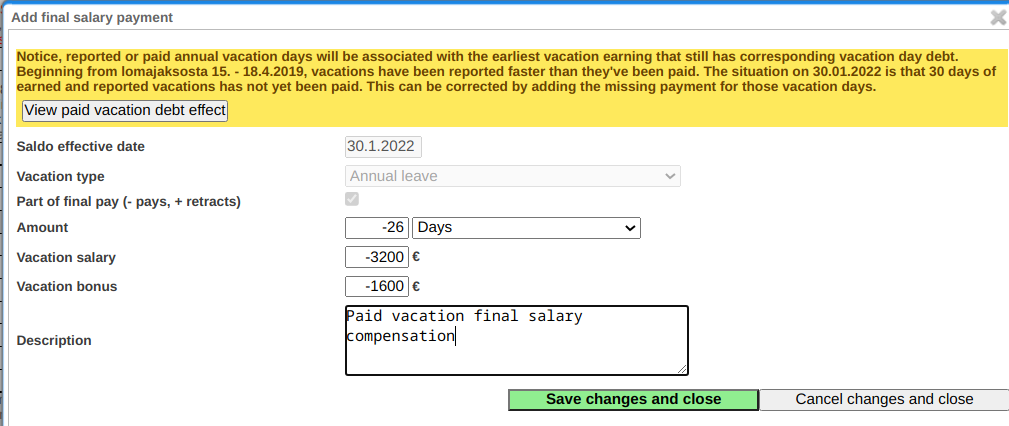

The creation of paid vacation final salary payments can also be fully automatized by enabling the setting Vacation calculation preferences: Generate paid vacation final salary payments automatically.

With this setting, Tuntinetti will automatically generate paid vacation final salary payments to the last day of employment. The payments can be viewed and manually edited from time reports containing the contract end date, by clicking the above mentioned button Payable: Final salary.

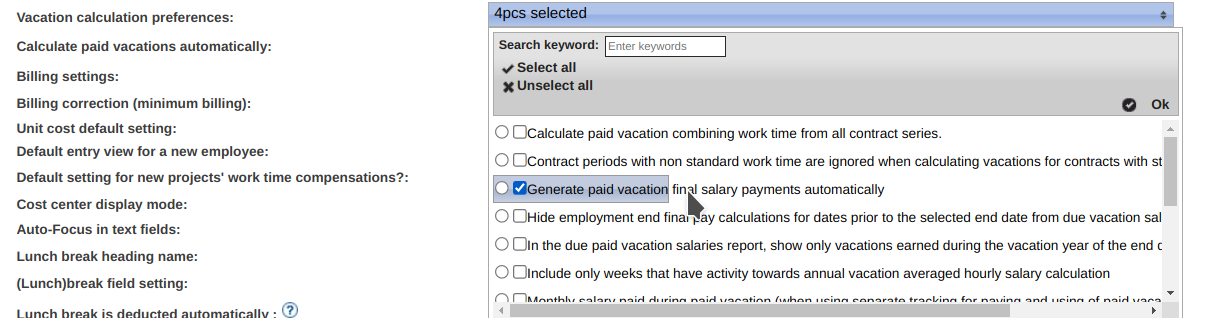

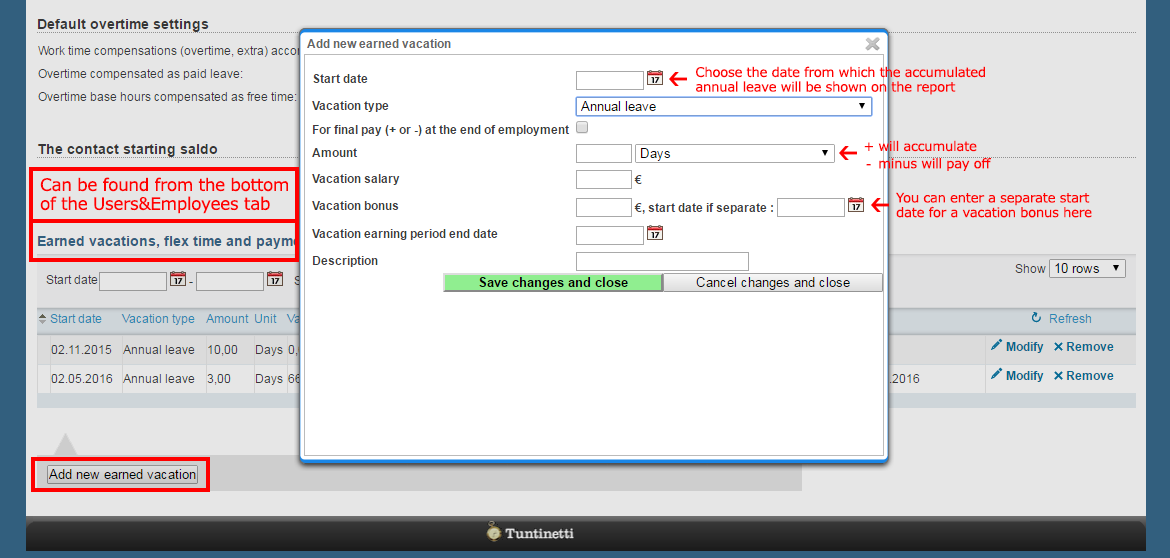

Final salary may contain payments for other vacation types (flex time / work time reduction / additional leave). These can be added manually in "Earned vacations, flex time and payments" section, but the payments can also be automatized with the feature Automatic calculation of final pay and annual vacation payments. Make sure to also select the correct vacation type related settings explained in the section 2.1.1 Additional settings for feature Automatic calculation of final pay and annual vacation payments. The automatic final salary payments can be seen in:

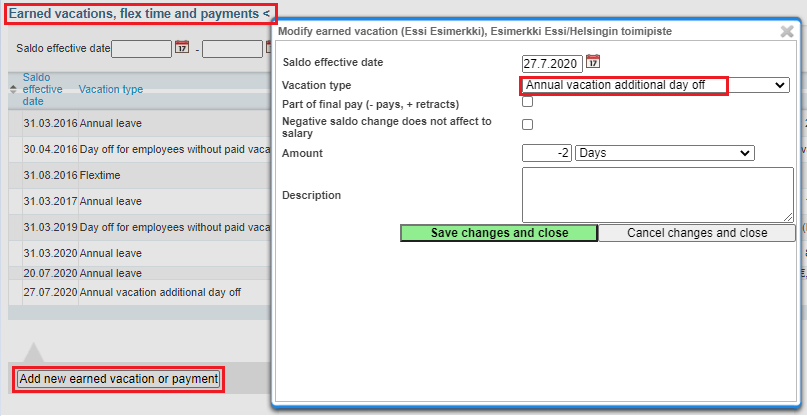

"Earned vacations, flex time and payments" section:

And in time report summaries:

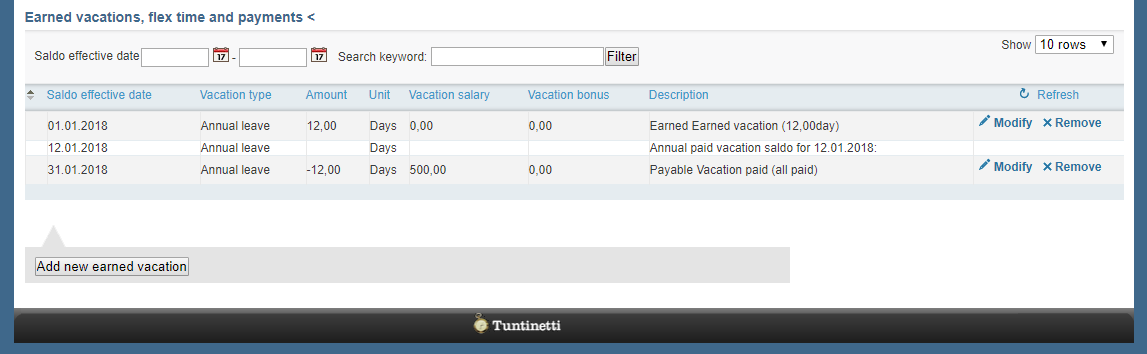

5. Marking vacation balance as paid

Annual vacation is marked as paid with payment order in Users → Employees tab's "Earned vacations, flex time and payments" section with a negative row.

It is also possible to set a different payment date to a vacation bonus.

Without a payment order the due vacation salary balance is not deducted when the payment orders are managed through Tuntinetti.

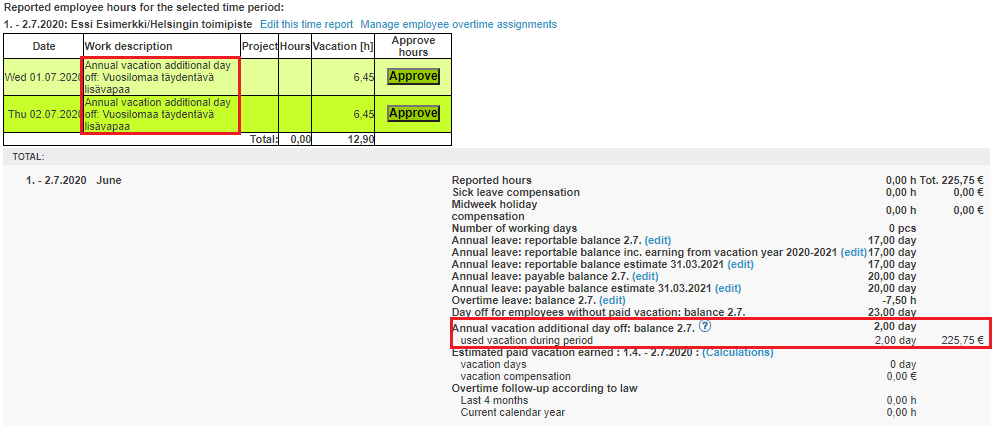

6. Additional leave to supplement the annual vacation

In reform of annual vacations act an employee may earn paid additional leave during absence of illness or medical rehabilitation. This additional leave doesn’t earn new vacation as actual annual vacation does.

In Tuntinetti this can be seen as a new vacation type “Annual vacation additional day off” which has its own balance. Used additional leave is compensated based on hourly report, similarly to work time reduction-leave:

Additional leave can also be directly compensated as salary through payment order:

If your company has enabled the additional feature "Automatic calculation of final pay ", unpaid additional vacation balance will be added to the final salary.

The amount of earned additional leave is listed together with annual vacation earning information, for example in annual vacation calculation panel and in annual vacation debt-reports:

7. More information in Guidebook

The number of vacation days and vacation salary/bonus are calculated based on the Finnish Annual Leave Law and collective bargain applied in employment relationship. You can read more about regulations regarding annual leave and their application in this Annual leave guide (only in Finnish).