This page goes through reforms that will take place in the future, which also partially concern Tuntinetti or the usage of Tuntinetti.

Working Hours Act and Annual Vacation Act

Working Time Act changes

The new Working Time Act (872/2019) entered into force on 1 January 2020.

The new Working Time Act caters to changes in the labour market and working life, such as the growing popularity of time and location independent working. The reform also caters to the requirements of the Working Time Directive and its interpretations.

The key points of the changes:

- In the new Act, sectors where period-based work is permitted have been more generally defined, and the list has been updated to meet the new needs of working life.

- The new Act provides more opportunities for night work. The new Act permits temporary night work on all tasks. The number of consecutive night shifts is restricted to address the health and safety risks associated with night work. The new Working Time Act limits the maximum number of consecutive night shifts in period-based work and uninterrupted shift work to five (from the previous seven).

- An employer and an employee may agree to extend daily regular working time by no more than two hours. Regular weekly working hours may not exceed 48. (previously 9 hours/day and 45 hours/week). The average weekly regular working time may not exceed 40 hours over a period of no more than four months.

- In the flexitime arrangement at the end of the reference period, the accrued excess may not exceed 60 hours (compared to the previous 40 hours) and deficit may not exceed 20 hours.

- A new provision on flexible working hours has been added to the Working Time Act. The employer and the employee may deviate from the provisions of a collective agreement concerning duration and timing of regular working time, and agree on a flexible working hours arrangement whereby the employee may independently decide on the timing and place of performance of at least half of the working time. The flexible working hours agreement shall be concluded in writing. The weekly regular working time may not exceed 40 hours during a four-month adjustment period.

- When working flexible working hours, the employee shall provide the employer with a list of hours worked during regular working time for each pay period such that the list indicates the weekly working time and weekly rest period. The employer is obligated to record in the working time register this information provided by the employee.

- The Act contains a new provision regarding a working time account. A working time account refers to a system for combining work and private life that allows employees to save and combine working hours, earned leave or monetary benefits exchanged for leave.

- When employees use the time saved in the working time account as leave, they will be paid a regular salary to which they are entitled at the time the leave is taken.

- The new Working Time Act no longer regulates the maximum amount of overtime. Instead, it contains provisions regarding the maximum number of employees’ total working hours.

Working Hours Act in Tuntinetti

In Tuntinetti different work time arrangements are already pretty flexible with flexitime, flexitime bank and overtime assignments. The changes in the Working Hours Act will be included to the current features of Tuntinetti and they are expanded to meet the needs of the specifications of the reform if needed. This way you are able to follow new specifications just by using Tuntinetti’s current features. Instructions on how to follow the new amendments will be published in Tuntinetti before they come into effect.

Annual Holidays Act changes

Amendments to the Annual Holidays Act safeguard the employees’ right to four weeks of paid annual leave, as mandated by the European Union legislation, even if they have been absent from work due to sickness or medical rehabilitation. In addition, the amendments extend the time period during which the employee may take their annual holiday that has been postponed due to incapacity for work.

The Act will enter into force at the beginning of the leave-earning year that starts on 1 April 2019.

- Provisions on the employees’ right to additional leave days supplementing their annual holiday will be included in the Annual Holidays Act. Employees will be entitled to additional leave if they have earned less than 24 annual leave days because of absence from work due to sickness or medical rehabilitation. Employees taking additional leave will be entitled to a remuneration corresponding to their regular or average wage.

- The Annual Holidays Act contains provisions on the postponing of annual leave due to incapacity for work. The amendments to the Annual Leave Act extend the period during which the annual leave, postponed due to incapacity, is to be taken.

Annual Vacation Act in Tuntinetti

Changes in Annual Vacation Act will be included to the vacation calculation module in Tuntinetti, and they will not require any separate actions from the user.

According to the changes in The Annual Holidays Act employees might be entitled to additional leave because of absence from work due to sickness or medical rehabilitation during the earning period. This additional leave is not considered equivalent to time at work for earning new annual vacation.

- In Tuntinetti you will see this new leave as a new vacation type 'Annual vacation additional day off' with saldo.

- Additional leave will be compensated using employee's average wage like in worktime reduction compensation or you can manage Additional leave compensation in "Earned vacations, flex time and payments"-section.

- If 'Automatic calculation of final pay' is in use, additional leave compensation is included in the final pay with other compensations due.

- Additional leave compensations are assembled with annual vacation for example in the Annual vacation explanation panel and in the Due paid vacation salaries -listing.

- See also instructions for Additional leave to supplement the annual vacation

General Data Protection Regulation

GDPR replaces the old Data Protection Directive

In May 2016 General Data Protection Directive came into effect, which is a directive that concerns the whole European Union. The deployment of the directive is done with a two year transition period and the directive has been followed since 25.5.2018.

The aim of the directive is to update and unify data protection regulations and to meet the needs of technology advancements. This way it can support the development of digital economy.

Mainly the new regulations are already so called good practises of the line of business, which Tuntinetti strives to achieve. Tuntinetti doesn’t create any additional costs to your company concerning the GDPR.

Who does the directive affect

The directive affects every organization, which has personal data registers or handles personal data information. Personal data information refers to data from which it is possible to identify a person.The directive gives rights to consumers and adds requirements to organizations.

What does GDPR contain

- Organization must have a user’s consent to collect personal information from the user. The consent must be clear and distinguishable from other matters and the users must select it themselves. This means that accepting to long illegible terms and conditions will not meet these new standards. Users must accept personal data collection themselves and it must be as easy to withdraw the consent as it is to give it. Naturally for example employee’s employment contract can require some personal information during employment and it is legal and doesn’t require a separate permit.

- Collecting personal information from minors is limited.

- User must have the right to be forgotten. This means that a user can ask for his or her information to be erased from the organization software and the information will be erased if there aren’t any data that is required to be saved by the law. User must also have the right to see the data that has been collected concerning him or her.

- Company must be able to show authorities that the GDPR is being followed. This can be done by deploying operation models for different stages of information gathering and by documenting their deployment and the decisions of demployment.

- A data breach to a company must be informed to the proper authorities within 72 hours of first having become aware of the breach. If the breach results in a risk for the right and freedom of individuals, the individuals must also be informed.

- If a company processes personal information in a large scale regularly or if the processing is directed to specific personal information groups or criminal activity information, the company must appoind a Data Protection Officer. The Data Protection Officer monitors and makes sure that data is handled securely and that data is being protected appropriately.

GDPR in Tuntinetti

With the new Tuntinetti user interface, a Data Protection Officer can for example examine personal information handling logs, if there is any doubt of unauthoritized processing of personal information. The log files contain the information of who has been accessing to the personal information and when.

A user consent to process personal information must be aquired in a way that is described in the directive and in a way that it is easy to prove afterwards.

All information that has been collected concerning a user can be combined easily for him or her to see if the user wants to see it.

The schedule and instructions

GDPR entered into effect 25.5.2018, after the two-year transition period. During the transition period, the EU information security group WP 29 has created instructions on how to interpret the directive. In addition legislative changes concerning GDPR have been made during the transition period.

Changes to Tuntinetti general user agreement and terms imposed by GDPR has been in effect since 25.5.2018. Tuntinetti doesn’t create any additional costs to your company concerning GDPR.

National Incomes Register (KATRE)

In the future salaries will be submitted to the tax authorities digitally

National Incomes Register will be deployed for all earned income in the year 2019 and for pensions and benefits in the year 2020. This means that salary information will be submitted to the tax authorities digitally with the payment transaction. The Incomes Register will replace all annual notifications of wages paid to taxpayers, pension providers and unemployment insurance funds.

The aim of realtime Incomes Register is to coordinate earned income and social benefits, simplify the bureaucracy of social benefits and to reduce employers’ work burden. The Incomes Register will make it possible to fulfil the most common obligations related to wage payment with a single notification.

National Incomes Register and Tuntinetti one-click salary calculation

In the future you are able to submit a salary notification to the tax authorities digitally with a single click as you’re making the salary payment, within five days of the payment transaction. This will replace the earlier notifications to the public authorities.

The schedule and instructions

National Incomes Register will be deployed in two stages. The first stage concerns all earned income and takes place 1.1.2019. The second stage will include pension and benefit information and takes place 1.1.2021 (originally planned as 1.1.2020). The last annual notification of earned income will concern the year 2018.

Legal elements of the reform includes in Tuntinetti payrolls official announcement modul if you have it in use. It will not add costs for your company. For electronic export you can choose “Electronic export of incomes register reports” from Tuntinetti’s paid features.

Companies that have Tuntinetti salary calculation in use should order an electronic certificate. Before ordering the certificate, you should add Tuntinetti`s paid feature called “Electronic export of income register reports”. According to the Tax Administration's frequently asked questions, each company announcing the SaaS service also acquires a certificate. A certificate's technical contact can be named as a SaaS Service Provider, so he can, on a technical level (upon receipt of a certificate), apply for a certificate to obtain and install it (https://www.vero.fi/en/incomes-register/companies-and-organisations/employers/certificate/).

To apply the technical interface of the application, you can make an entry in the electronic transaction service https://www.vero.fi/tulorekisteri/yritykset-ja-organisaatiot/suorituksen-maksajat/varmenne/

The interface to be used in the application is:

- Real-time Web Service interface

Larger companies can also take the following interfaces just in case:

- Deferred Web Service interface

- SFTP interface

After ordering the certificate you get an e-mail to given e-mail adress. To open this e-mail you would need a PIN-code that will be sent to the phone number you gave on the order. NOTE! This e-mail can be opened only once!

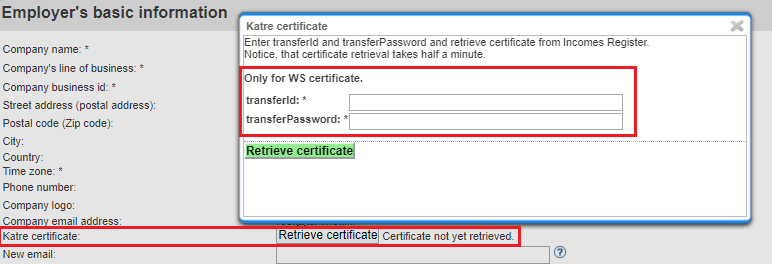

In Tuntinetti the certificate should be added on Basic Settings-tab (if the certificate concerns the whole company) or on Units-tab (if the certificate concerns an affiliated company). From the certificate e-mail you should collect the information of TransferId and TransferPassword. The certificate can be used as soon as it has been saved.