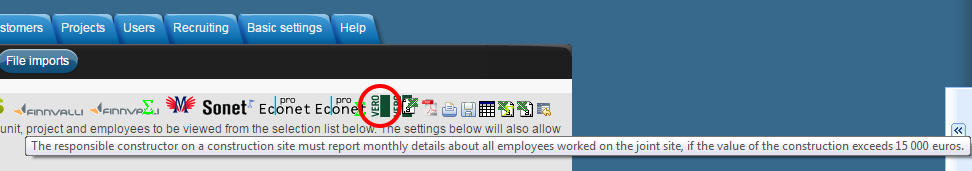

It is possible to activate the Notification obligation in construction business feature in Tuntinetti's paid features. With this feature it is possible to make a legitimate notification according to the notification obligation for the tax authority via the ilmoitin.fi or veronumero.fi services. The button for making a notification can be found in the "Time reports" tab on "Time reports for payroll" view.

Notification obligation shortly

In July 2014 a new notification obligation concerning building contracts and construction workers came into effect. Especially construction contractors now have to provide more information to the tax authorities. Also the construction customers, such as contractors and housing cooperatives, have new notification obligations.

It is important to do these obligations responsibly from the start. If the one who is obligated doesn't deliver all of the needed information or delivers incorrect information, they can end up having to pay a neglience fine which can be up to 15 000 euros.

Handling information can produce more work and costs but with a suitable software the effects can be minimized.

Who does the notification obligation concern?

The notification obligation is divided to two different parts: contract information and employee information. The contract information has to be delivered from every construction services that are included in the Value Added Tax Act. Employee information has to be delivered from work that is done in a shared construction site.

The subscriber of the construction work, usually the constructor, is obliged to deliver the construction site's information to the tax authorities. When ordering construction services, a housing cooperative is also counted as a construction subscriber.

The notification obligation concerns also households, but only when the work that is done needs a construction permit.

So what does the notification obligation mean in practice?

Especially collecting employee information demands careful accounting. The main executor has to keep documents of every person working on the construction site, including those who don't work for him, and deliver their information to the tax authorities monthly. The information has to have information concerning all of the people working there. Including those who don't do actual construction work, such as cleaners, guards, office workers.

The documents need to be up-to-date and easily inspected by the authorities. The employees working on the construction site need to have a identifier with a picture, which has their tax id. Any subcontractors working on the site have to deliver their employee information to the main contractor.

With our automatic work time management solution, carrying out these obligations requires little to none extra work. The necessary information are compiled from the work time management systems and are sent to the tax authorities with a few mouse clicks.

A guide on how to deliver the necessary information to the tax authorities in Tuntinetti

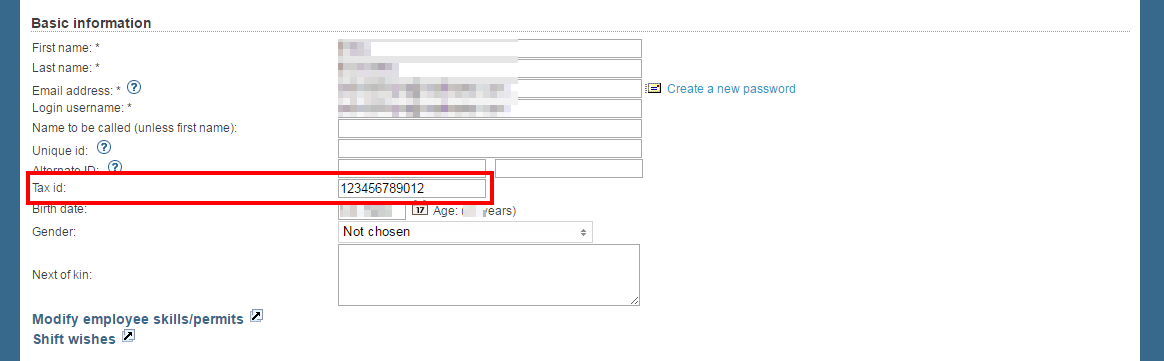

1. Let's start with entering a tax id to the employee. This can be done in the Users tab. The tax id is 12 digits long.

2. Enter the Buyer construction site id number or Construction site id for reporting in the project's basic information in the Projects tab.

3. In the tax notification you should also inform the address of the construction site. Tuntinetti gets the information from the project's customer.

Select a customer for the project.

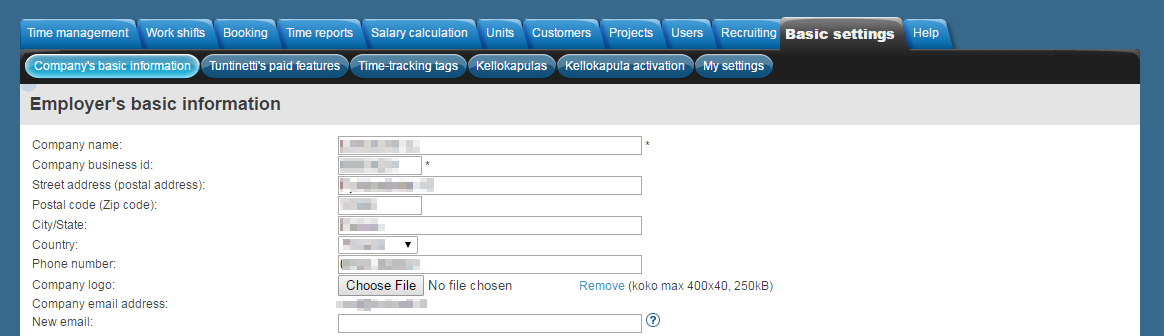

4. The notification to the tax authorities must include your company name, business id and contact information.

Confirm that your company's basic information is up-to-date.

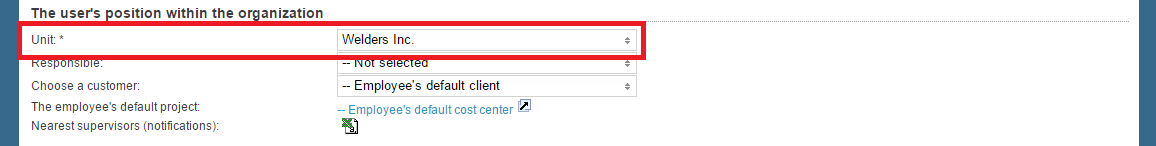

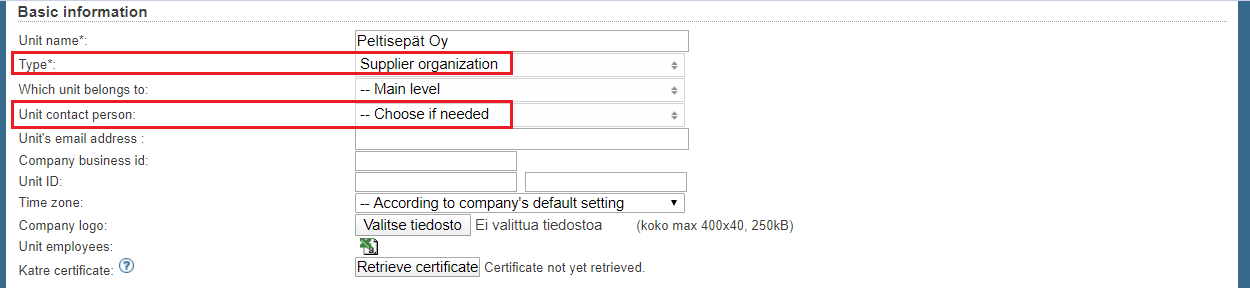

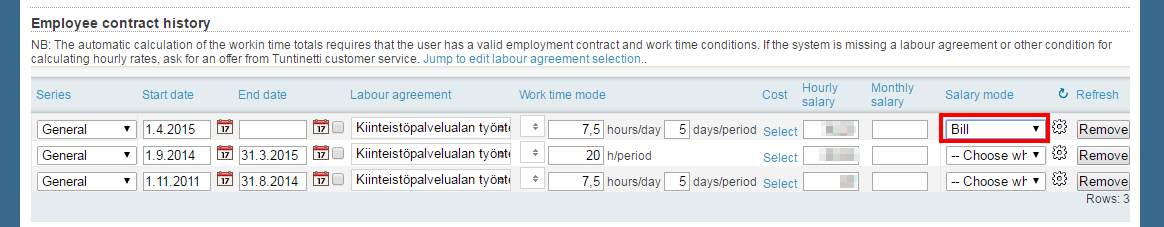

5. If you use a agency workers, their work contract should have the Bill information set and the employee's unit should be a unit that is named after the customer (for example Welders Inc.). This unit's type should also be set to Supplier organization.

Make sure these are correct.

Also unit contact person is required when unit type is "Supplier organization".

6. Forming a notification file.

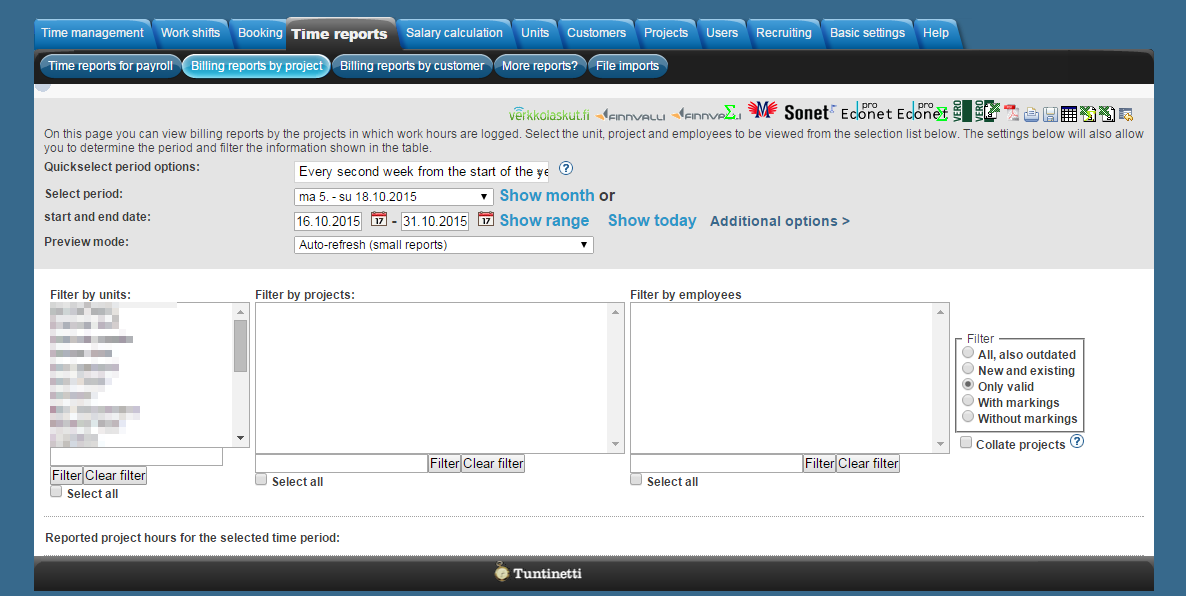

Go to the Time reports → Billing reports by project tab.

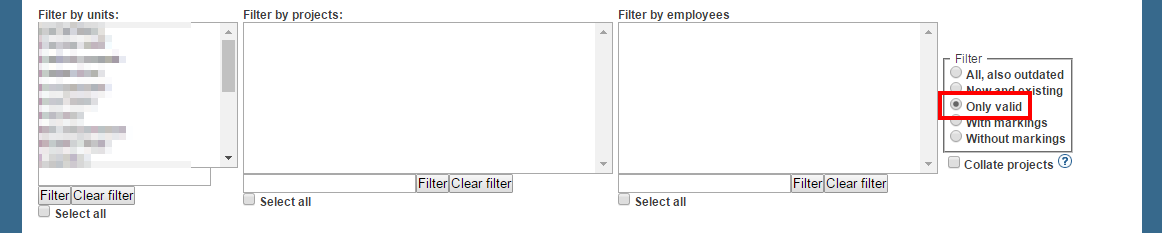

Select only valid to be shown.

Select the projects that you want to be included in the notification.

Click the download construction report -button.

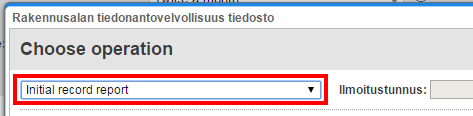

If you are informing the month's information the first time, select the Initial record report.

Mont's first notification is always an initial record report, which the tax authorities creates an id, so you don't have to enter that. When you have sent the initial record report, you receive a confirmation including the unique id and a confirmation of the time when the notification was sent.

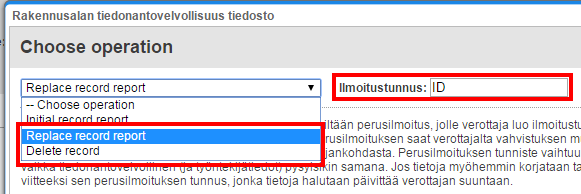

If you want to create a replacing or additive notification or remove a notification, select Replace record report or Delete record.

When replacing or deleting an old notification, you should enter the correct id.

7. Sending a notification to the tax authorities.

Further instruction on how to send a notification to the tax authorities with the Katso-account:

A guide video on how to use the Ilmoitin.fi-service to send files: https://www.dreambroker.com/channel/85pp1zoe/9nx2csyz

More information http://www.vero.fi/en-US/Companies_and_organisations/Construction_work_reports